The Cost Of Smoke & Fire Damage For Insurance Claims Infographic

Tips On Estimating Smoke and Fire Damage Restoration Costs

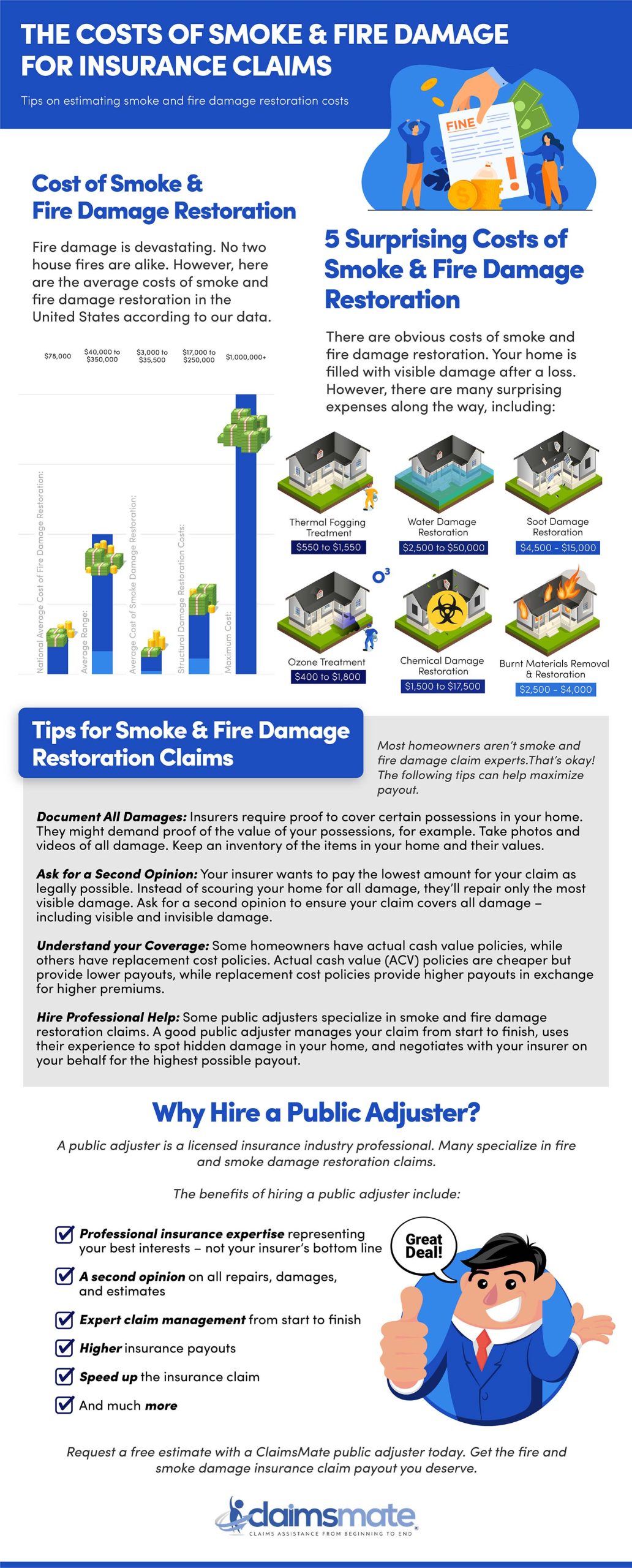

Cost of Smoke & Fire Damage Restoration

Fire damage is devastating. No two house fires are alike. However, here are the average costs of smoke and fire damage restoration in the United States according to our data.

- National Average Cost of Smoke & Fire Damage Restoration: $78,000

- Average Range: $40,000 to $350,000

- Average Cost of Smoke Damage Restoration: $3,000 to $35,500

- Structural Damage Restoration Costs: $17,000 to $250,000

- Maximum Cost: $1,000,000+

5 Surprising Costs of Smoke & Fire Damage Restoration

There are obvious costs of smoke and fire damage restoration. Your home is filled with visible damage after a loss. However, there are many surprising expenses along the way, including:

- Thermal Fogging Treatment: $550 to $1,550

- Ozone Treatment: $400 to $1,800

- Water Damage Restoration: $2,500 to $50,000

- Chemical Damage Restoration: $1,500 to $17,500

- Soot Damage Restoration: $4,500 to $15,000

- Burnt Material Removal & Restoration: $2,500 to $4,000

Tips for Smoke & Fire Damage Restoration Claims

Most homeowners aren’t smoke and fire damage claim experts. That’s okay! The following tips can help maximize payout.

Document All Damages: Insurers require proof to cover certain possessions in your home. They might demand proof of the value of your possessions, for example. Take photos and videos of all damage. Keep an inventory of the items in your home and their values.

Ask for a Second Opinion: Your insurer wants to pay the lowest amount for your claim as legally possible. Instead of scouring your home for all damage, they’ll repair only the most visible damage. Ask for a second opinion to ensure your claim covers all damage – including visible and invisible damage.

Understand your Coverage: Some homeowners have actual cash value policies, while others have replacement cost policies. Actual cash value (ACV) policies are cheaper but provide lower payouts, while replacement cost policies provide higher payouts in exchange for higher premiums.

Hire Professional Help: Some public adjusters specialize in smoke and fire damage restoration claims. A good public adjuster manages your claim from start to finish, uses their experience to spot hidden damage in your home, and negotiates with your insurer on your behalf for the highest possible payout.

Why Hire a Public Adjuster?

A public adjuster is a licensed insurance industry professional. Many specialize in fire and smoke damage restoration claims.

The benefits of hiring a public adjuster include:

Professional insurance expertise representing your best interests – not your insurer’s bottom line

A second opinion on all repairs, damages, and estimates

Expert claim management from start to finish

Higher insurance payouts

Speed up the insurance claim

And much more

Request a free estimate with a ClaimsMate public adjuster today. Get the fire and smoke damage insurance claim payout you deserve.