CONTENTS

CONTENTS .......................................................................................................... 1

THE FIRST STEPS ............................................................................................ 2

WHAT HOME INSURANCE COVERS AND DOES NOT COVER .............................................. 3

READING YOUR DECLARATIONS PAGE ................................................................................... 4

ESTIMATING DAMAGE ................................................................................... 5

FIRE DAMAGE RESTORATION COSTS ........................................................................................ 6

HOUSE FIRE CLASSES & CATEGORIES .................................................................................... 6

SMOKE AND SOOT DAMAGE RESTORATION COSTS ............................................................. 7

WATER DAMAGE RESTORATION COSTS ...................................................................................8

WIND DAMAGE RESTORATION COSTS ......................................................................................8

REPAIRING VERSUS REBUILDING YOUR HOME................................... 9

WHO DECIDES? ............................................................................................................................... 10

REPAIRING VERSUS REBUILDING: PROS AND CONS ......................................................... 11

REPLACEMENT COST VS. ACTUAL CASH VALUE POLICIES ............................................. 12

HOW TO DEAL WITH YOUR INSURANCE COMPANY’S ADJUSTER . 13

WHAT TO DO AND WHAT NOT TO DO ........................................................................................ 14

INSURANCE CLAIM ROADBLOCKS ......................................................... 15

WHY INSURERS DENY CLAIMS .................................................................................................. 16

HOW INSURERS JUSTIFY LOWER PAYOUTS .......................................................................... 17

STEPS TO TAKE AFTER CLAIM DENIAL...................................................................................

18

HIRING PROFESSIONAL INSURANCE CLAIMS HELP ........................ 19

PUBLIC ADJUSTERS VERSUS ATTORNEYS .......................................................................... 20

HOW PUBLIC ADJUSTERS HELP .............................................................. 21

TOP 3 THINGS PUBLIC ADJUSTERS DO ................................................................................. 22

FAQS ................................................................................................................. 23

FREQUENTLY ASKED QUESTIONS ........................................................................................... 23

SOURCES.........................................................................................................................................

23

2 of 23

THE FIRST STEPS

Major insurance claims are frustrating and complicated. To make

things worse, most homeowners aren’t experts.

The average homeowner deals with one major home insurance claim

in their life.

Unfortunately, insurers take advantage of your

inexperience.

We can help you get the payout you paid for.

1)

2)

3)

4)

5)

Secure the Scene

Contact emergency services if necessary. Protect yourself

and loved ones from immediate danger.

Call your Insurer

Your insurer explains the next steps. The sooner

you contact

your insurer, the sooner the claim process

begins.

Contact a Restoration Contractor

Emergency contractors work 24/7. Contractors

secure your

property and prevent further damage.

Take Photos and Document the Damage

Your insurer needs proof of the loss. Take photos and videos

of damaged property.

Wait for the Restoration Contractor to Complete

the Project

The contractor restores your property to pre-loss condition.

3 of 23

1

* Flood and earthquake insurance are available through FEMA in some areas.

COVERED

NOT COVERED

Fire ✓

Floods*

Smoke ✓

Earthquakes*

1

Wind ✓

Nuclear Accidents

Theft / Vandalism ✓

Termites, insects, rats, mice, and pests

Tree damage ✓

Wear and tear

WHAT HOME INSURANCE COVERS AND

DOES NOT COVER

You assume home insurance will be there when you

need

it most. Unfortunately, that’s not always the case.

4 of 23

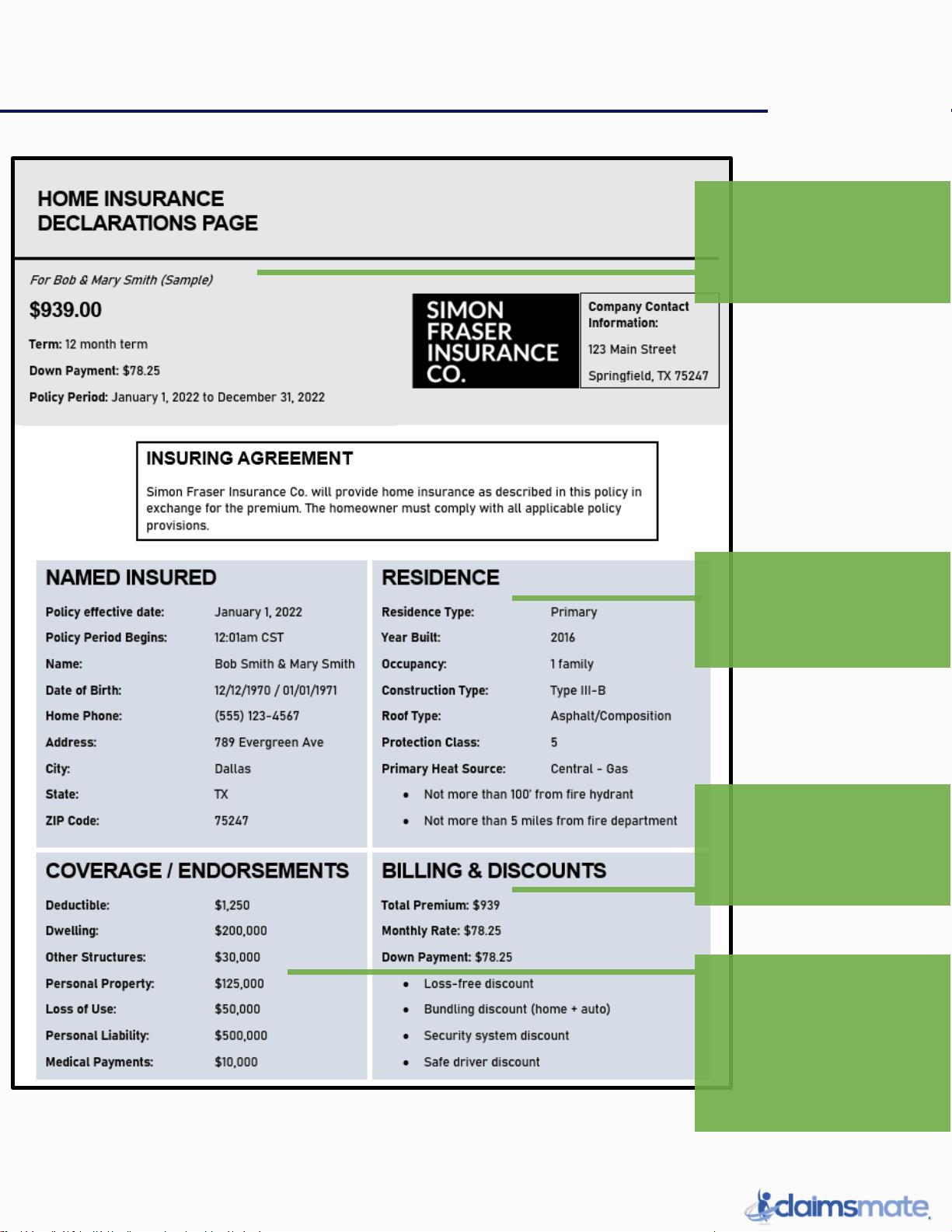

READING YOUR DECLARATIONS PAGE

Your declarations page

explains your coverage

and how it works

It also lists certain

risks and features of

your home.

This is the total amount

you owe your insurer

over the policy term.

Discover coverage

limits included in your

policy, as well as any

endorsements

(additional coverages).

5 of 23

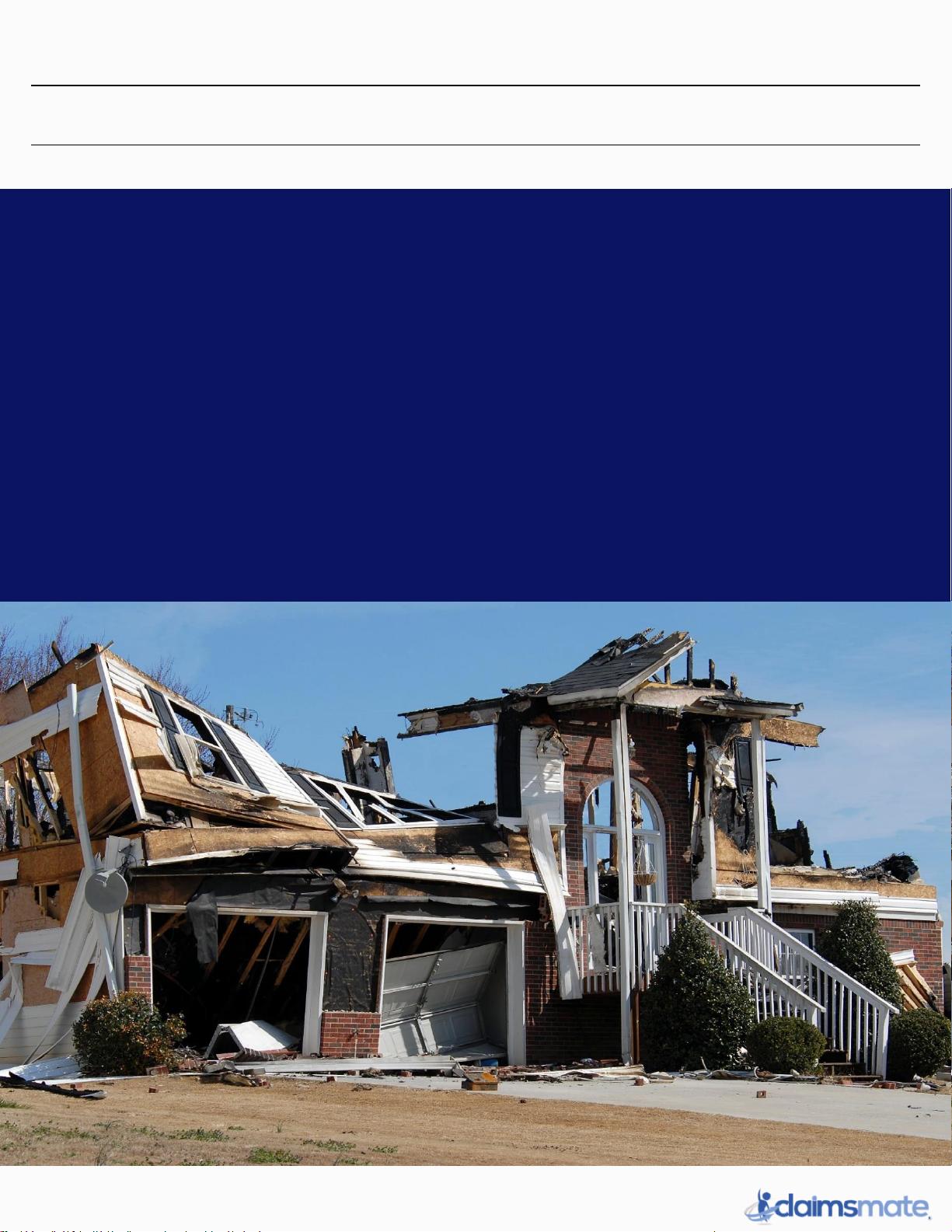

ESTIMATING DAMAGE

Your insurance company’s adjuster estimates damages:

• The adjuster surveys your property to assess damage

• You must cooperate with the adjuster during the survey

• The adjuster creates a report based on the survey

Based on the adjuster’s report, you could receive

10% to 100%

of the payout you deserve.

Insurance adjusters use the cheapest

cost estimates. They want

to pay you as little for your claim as legally possible.

6 of 23

2

(US Department of Labor, 1996)

3

(Angi, 2021)

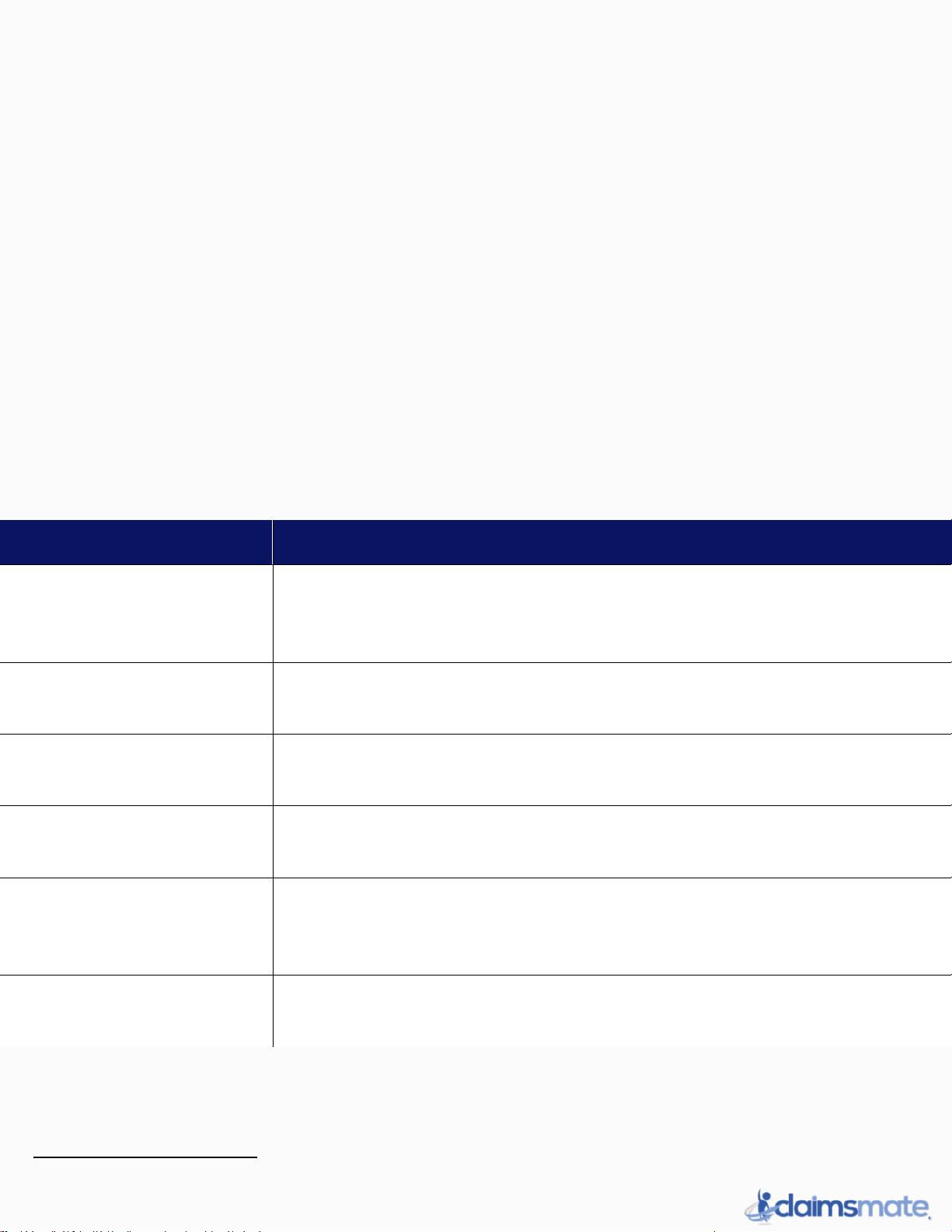

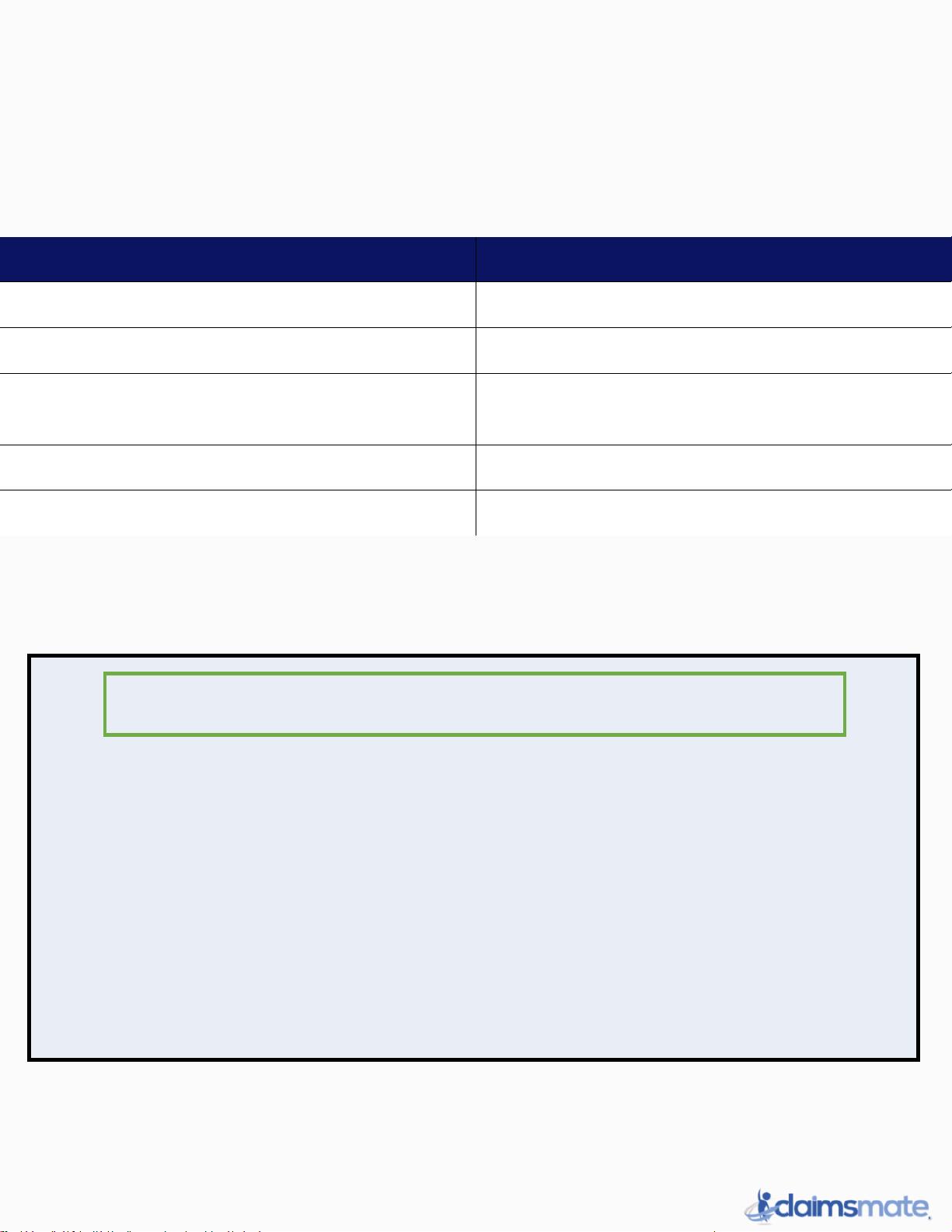

Fire Class

2

Type of Damage

Class A

Ordinary materials (like

cloth or wood)

Class B

Flammable liquids (like

alcohol or solv ents)

Class C

Electrical equipment

(like appliances or bad

wiring)

Class D

Combustible metals

(like aluminum or

magnesium)

Class K

Kitchen substances

(animal oils, fats, or

deep fryers)

National Average

Cost

3

$5,000 to $70,000

Water Damage

Cleanup (After Fire)

$1,000 to $4,000

Soot Removal and

Cleanup

$2,000 to $6,000

Removal of Damaged

Items

$50 to $100 per pound

Duct Cleaning

$200 to $500

Deodorizing Costs

$200 to $1,000

Restoring fire damage can cost

anywhere from $1,000 to $100,000. If you

need to rebuild your home, it could cost

over $100,000.

The average policyholder pays around

$22,000 to restore fire damage.

Restoration companies rate fires based on

Class.

The cost of fire damage restoration varies

based on water damage, soot removal,

smoke cleanup, and miscellaneous cleanup

costs.

Types of fire damage by class.

Average cost of fire damage

restoration

FIRE DAMAGE RESTORATION COSTS

HOUSE FIRE CLASSES & CATEGORIES

7 of 23

4

(Home Advisor, 2021)

National Average Cost

4

$2,000 to $6,000

Smoke Restoration Costs

$200 to $1,000

Furniture and Texture

Deodorizing Costs

$200 to $1,000

Thermal Fogging

$200 to $600

Ozone Smoke Removal

$200 to $400

Homeowners know the destructive power of

fire. Smoke and soot, however, can be more

devastating.

Smoke and soot spread throughout your

home during the fire.

Remediating smoke and soot damage adds

thousands to an insurance claim.

Average cost of smoke and soot

damage restoration.

SMOKE AND SOOT DAMAGE

RESTORATION COSTS

DID YOU KNOW?

Public adjusters force your insurance company to

pay

the full amount for your fire, smoke, and soot damage.

Public adjusters:

• Analyze damages ✓

• Negotiate with your insurer for higher payouts ✓

• Oversee restoration ✓

A good public adjuster can increase your insurance

settlement by 700% or more.

8 of 23

5

(Home Advisor, 2021)

6

(HomeAdvisor, 2021)

National Average

Cost

5

$3,000 to $15,000

Cost by Area

$3.75 to $7 per square

foot

Category 1 (Clean

Water)

$3.75 per square foot

Category 2 (Grey

Water)

$4.50 per square foot

Category 3 (Black

Water)

$7 per square foot

Mold Restoration and

Removal

$2,000 to $5,000

National Average Cost

6

$3,000 to $20,000

Full Asphalt Shingle

Roof Replacement

$1,700 to $8,400

Siding Repair

$1,200

Broken Window s

$100 to $600 per

window

Water can cause visible and invisible

damage to your home.

Some water damage is obvious. Other damage

is hidden behind your walls or underneath your

floors.

Windstorm damage is unpredictable. Some

windstorms cause extensive losses.

Your insurance covers roof repair, tree

removal, water extraction, and structure

repairs after a windstorm.

WIND DAMAGE RESTORATION COSTS

Average cost of water damage

restoration in the United States

WATER DAMAGE RESTORATION COSTS

Average cost of wind damage

restoration in the United States

9 of 23

REPAIRING VERSUS REBUILDING YOUR HOME

Deciding whether to repair or rebuild your home is

a life-

changing decision.

Your policy impacts your decision: you may have

a

replacement cost policy or an actual

cash value (ACV)

policy.

Your insurer always pushes for the cheapest option, which

may not be the best option. Prepare to negotiate.

Who Decides?Deciding whether to repair or rebuild your home

is a life-changing decision.

In some cases, your insurer forces you to repair or rebuild your

home. In other cases, it’s up to you and your public adjuster to

make the best decision for you.

10 of 23

WHO DECIDES?

Your insurer wants the cheapest option. You want the

best option. Who

decides?

• Traditionally, you had to rebuild a house of the same kind and

quality at the original location to receive payment from your

insurer.

• Things have changed. More than 20 states have passed laws

allowing you to receive the same compensation for

rebuilding or repairing your home at its original

location or

elsewhere.

• In most cases, you rebuild your home if the cost of repairing

damage is greater than half the value of the house itself.

• In some areas, your local building inspector decides whether

to repair or rebuild – say, for flood-damaged homes in low-lying

areas.

• If you have a mortgage, your lender has a say.

The decision is complicated, and multiple parties are

involved.

PARTIES INVOLVED IN THE DECISION

INSURER

Pushes for the cheapest option

HOMEOWNER

Pushes for the best option

LENDER

Pushes for the safest option

LOCAL

INSPECTOR

Has final say in certain claims (like

flood-damaged homes and

homes in low-lying areas)

11 of 23

REPAIRING VERSUS REBUILDING: PROS AND CONS

Choosing to repair or rebuild is a big decision.

Both approaches have

advantages and disadvantages.

REPAIRING: PROS & CONS

PROS

CONS

Save money (cheaper option)

May find additional damage during repairs

(or leave certain damage unfixed)

May be able to occupy the home during

repairs

May be leaving money on the table if you

have a replacement cost policy

Ideal for smaller insurance claims

REBUILDING: PROS & CONS

PROS

CONS

Ideal if you plan to stay in your home for a

long time (reset all wear and tear in your

home)

Costs can quickly exceed expectations, and

insurance only covers a specific amount

Remove all traces of damage from your

home after a major insurance claim

All or nothing (once you start demolishing

your home, you can’t change your mind)

Ideal for homeowners with replacement

cost policies

May need alternative accommodations for

months

You get a new home

Insurance does not pay to rebuild the home

to its original condition if you have an

actual cash value (ACV) policy (unless you

paid for an inflation clause)

12 of 23

REPLACEMENT COST VS. ACTUAL CASH VALUE POLICIES

When buying home insurance, you choose a replacement

cost or actual

cash value (ACV) policy.

Both policies cover damage to your home and its possessions.

However,

they cover damage in different ways.

REPLACEMENT COST

Replacement cost policies pay to repair or replace

damaged property

without deducting depreciation.

A replacement cost policy:

• Covers the cost of rebuilding your home to pre-loss condition

• Pays out based on the square footage of your home and

construction costs in your area

• Is more expensive than actual cash value policies

ACTUAL CASH VALUE

Actual cash value policies cover the cost of damaged

property after

deducting depreciation costs.

An ACV policy:

• Does not rebuild your home to pre-loss condition

• Pays out based on the value of your home and possessions

before the loss

• Is cheaper than replacement cost policies

13 of 23

HOW TO DEAL WITH YOUR INSURANCE COMPANY’S

ADJUSTER

You interact with your insurance company’s adjuster

throughout the claim.

By law, you must respond to your insurance company’s

adjuster

honestly and promptly.

A good relationship with your insurance adjuster makes a claim

easier. However, it’s important to not let the adjuster push

you around or take advantage of your inexperience.

The adjuster may be friendly, but the adjuster is not your

friend. They want to protect their employer’s bottom line.

14 of 23

WHAT TO DO AND WHAT NOT TO DO

Your insurance company’s adjuster is doing their job. However, you have

a responsibility to protect your financial future.

When dealing with your insurance adjuster, there are

things you should

do to optimize your insurance claim.

For a smooth claim, follow the tips below.

WHAT TO DO

To ensure a good relationship, practice the following

strategies:

• Respond promptly to the insurance adjuster’s requests. ✓

• Be honest about your loss. ✓

• Submit documents, evidence, and photographs within the time

specified by your insurance policy. ✓

• Document interactions and phone conversations, including dates,

times, and topics discussed. ✓

WHAT NOT TO DO

Certain actions could jeopardize

your claim. Avoid problems with the

following tips:

• Do not give the insurance adjuster more details than

requested ×

• Don’t be intimidated by your insurance adjuster. Most

insurance adjusters are normal people doing their jobs. ×

• Do not sign anything or provide a recorded statement. ×

• Do not accept the first offer. ×

15 of 23

INSURANCE CLAIM ROADBLOCKS

Major insurance claims are complex. There’s a lot of money at

stake, and insurers may challenge certain damages.

If the damage came from a legitimate covered loss, you have

nothing to worry about: the insurer is legally

obligated to cover

your claim.

However, there may be roadblocks. Prepare for roadblocks

today to avoid insurance headaches in the future.

16 of 23

WHY INSURERS DENY CLAIMS

Insurers deny claims when they have a

legitimate reason to deny a

claim. However, insurers wrongfully deny roughly

10% of all insurance

claims.

7

Reasons to deny a claim include:

Lack of coverage / exclusion clauses

Your insurance policy does not cover everything. Your insurer

may deny your claims based on exclusions and

insufficient

coverage.

Missing the filing deadline

Typically, homeowners have 30 days to 1 year

to file a claim. If

you miss the filing deadline, the insurer might

deny your claim.

Non-payment of premiums

You need to pay premiums on time.

Insurers may deny claims

because you did not pay your premiums.

False statements

Insurers lose billions to fraud every year. If you lied about your

claim, or if the insurer suspects fraud, the

insurer can deny your

claim.

Insufficient documentation

The insurer may require receipts, estimates,

photos, videos, and

other documents proving the loss.

Wear and tear / poor maintenance

Insurance covers sudden and unexpected damages. If you did

not maintain your property, then your insurer can

deny your claim.

7

(Insurance Information Institute, 2021)

17 of 23

HOW INSURERS JUSTIFY LOWER PAYOUTS

40% of homeowners report receiving a lower-than-expected payout

from their insurer.

8

The insurer may decide to cover certain

damages but not others, for

example.

Or, the insurer could use the lowest possible value for your

possessions, lowering your claim by thousands.

Insurers use several excuses to justify lower

payouts. Some are

legitimate. Others are negotiation tactics to convince you to accept a

lower offer.

REASON

EXPLANATION

Wind-driven rain

If strong winds caused water to enter your home, then

insurance may not cover damages. Insurance covers windstorm

and water damage, but it does not cover wind-driven

rain.

Cheap product

replacements

When replacing your possessions, insurers use the cheapest

possible replacement products they can find.

Flood damage

Insurers may decide that flooding caused

certain damages.

Windstorm damage is insured, but flood damage is

not.

Lack of maintenance

You must maintain your home. If you failed to

maintain your

property and it leads to a loss, insurers may lower payout.

Failure to limit

damage

You must take steps to limit damage after an

accident. If you did

not place a tarp over the hole in your roof

after a windstorm, for

example, your insurer might deny your claim.

Other reasons

Insurers use dozens of reasons to deny claims and justify lower

payouts. Ask for a written explanation from your insurer.

8

ClaimsMate.com

18 of 23

STEPS TO TAKE AFTER CLAIM DENIAL

If an insurer denies your claim, it’s not the end

of the road.

You have legal rights to challenge the claim.

Insurers allow you to

respond with evidence proving the claim is justified.

Alternatively, many policyholders hire professional

help – like a lawyer or

public adjuster. If your insurer denied your

claim, follow the steps below.

1) Say no

You don’t need to accept the first offer from

your insurance

company. Insurers wrongfully deny thousands of

claims each year.

2) Ask for a written explanation

Few insurers provide a written explanation of the

claim denial

unless you ask for it. However, you may need

this letter when

formally challenging your claim.

3) Check your policy

Look at your home insurance policy. Does the

insurance company

have a legitimate reason to deny your claim based

on the written

explanation?

4) Get professional help

Insurance companies aren’t charities. They’re for-profit businesses

that want to maximize profit. But they shouldn’t do it at your

expense. If the insurer has wrongfully denied your claim, then

consider getting professional help:

• Hire a public adjuster

• Hire an insurance attorney

• Contact your state’s Department of Insurance

19 of 23

HIRING PROFESSIONAL INSURANCE CLAIMS HELP

You’re not an insurance expert – and that’s okay.

When you need an insurance expert, you have two

options:

• Hire an attorney

• Hire a public adjuster

Both professionals play a similar role. In fact,

many

public adjusters are attorneys and vice versa.

However, depending on the stage of your

insurance

claim, you may want to hire one or the other.

20 of 23

PUBLIC ADJUSTERS VERSUS ATTORNEYS

Public adjusters and attorneys play similar

roles. They help policyholders

overturn denied claims and receive higher payouts.

PUBLIC ADJUSTERS

ATTORNEYS

Provide expert assistance for claims

Provide expert assistance for claims

Have a legal and/or insurance background

Have a legal background

Can manage your claim from start to end

Help with denied claims issues late in the

process

Negotiate and obtain higher payouts

Negotiate and obtain higher payouts

Work on a contingency basis

Charge hourly or on contingency

HOW MUCH DO PUBLIC ADJUSTERS COST?

You don’t pay until you accept your

insurer’s final settlement. This is

called a contingency fee agreement.

Public adjusters:

• Charge a pre-arranged fee of 10% to 15% of the final payout

• Depending on your agreement, could charge on the total

claim or only the additional amount awarded

• Are motivated to obtain highest possible payout from insurer

to receive higher commissions

21 of 23

HOW PUBLIC ADJUSTERS HELP

9

9

ClaimsMate.com

Public adjusters lend their expertise to your insurance claim.

This expertise can put more money in your pocket

when you

need it most.

Public adjusters can:

• Increase final payout by 700%

• Solve tricky insurance disputes

• Overturn denied claims

• Walk you through every step of the claim process

When you hire a public adjuster, you get a certified insurance

claim expert on your side.

9

22 of 23

TOP 3 THINGS PUBLIC ADJUSTERS DO

No two insurance claims are alike. Public

adjusters approach each case

differently and optimize your insurance claim via

several roles.

1) Assess your claim to determine fair compensation

A public adjuster works on your behalf. A public adjuster uses their

decades of insurance industry experience to

assess your claim and

determine fair compensation.

2) Negotiate with your insurer

Public adjusters negotiate the insurer to obtain

the optimal payout.

They use their experience and industry knowledge

to force insurers

to pay you the money you are rightfully owed.

3) Guide your insurance claim from start to finish

Policyholders feel relieved after hiring a

public adjuster. The public

adjuster performs countless tasks while

expertly guiding your

complex insurance claim from start to

finish.

BENEFITS OF HIRING A PUBLIC ADJUSTER

Hiring a public adjuster comes with little risk.

You benefit because

you:

• Get a second opinion on your insurance claim

• May get an increased payout by up to 700%, overturn denied

claims, and get the payout you paid for

• Pay nothing until you accept your insurer’s final payment offer

• Get a free consultation with zero risk

As a policyholder, you have little to lose by

hiring a public adjuster.

23 of 23

FAQS

FREQUENTLY ASKED QUESTIONS

Question

Answer

What is a public

adjuster?

A public adjuster is a licensed and certified

insurance industry professional who manages

your claim, negotiates with your insurer for a

higher settlement, and solves insurance claim

disputes.

What do public

adjusters do?

Public adjusters analyze your insurance claim

and negotiate with your insurer for a higher

payout.

How much do

public adjusters

cost?

Public adjusters set different prices based on

their experience. The average public adjuster

charges a fee of 7.5% to 15%.

SOURCES

Angi. (2021, November 5).

How Much Does Fire Damage Restoration Cost.

Retrieved November 11, 2021, from Angi: https://www.angi.com/articles/how-

much-does-fire-damage-restoration-cost.htm

Home Advisor. (2021, November).

2021 Water Damage Repair & Restore Costs.

Retrieved from HomeAdvisor Powered by Angi:

https://www.homeadvisor.com/cost/disaster-recovery/repair-water-damage/)

Home Advisor. (2021, November).

How Much Does It Cost to Repair Fire & Smoke

Damage?

Retrieved from Home Advisor:

https://www.homeadvisor.com/cost/disaster-recovery/repair-fire-and-smoke-damage/

HomeAdvisor. (2021, November).

How Much Does It Cost To Repair Hail, Wind, Or

Storm Damage?

Retrieved from HomeAdvisor:

https://www.homeadvisor.com/cost/disaster-recovery/repair-storm-or-wind-damage/

Insurance Information Institute. (2021, November).

Facts + Statistics: Homeowners and renters insurance.

Retrieved from Insurance Information

Institute:

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

US Department of Labor. (1996, May).

Classification of Portable Fire Extinguishers.

Retrieved from Occupational Safety & Health Administration:

https://web.archive.org/web/20080401035246/http://www.osha.gov/doc/outreachtraining/htmlfiles/extmark.html

24 of 23

All new customers are eligible for a free

consultation.

Our expert public adjuster:

• Reviews your case ✓

• Recommends the optimal solution for your

claim ✓

• Answers your questions without obligation on

your part to purchase anything ✓

Contact us today for your free consultation. Get the

payout you paid for.

GET A FREE

CONSULTATION

Get help at claimsmate.com | (877) 202-0204

Get expert help at claimsmate.com|(877) 202-0204